- Built By Berkeley

- Posts

- Built By Berkeley

Built By Berkeley

Record funding, historic exits, and a banner year for Berkeley

I thought 2024 was a whopper year for Berkeley innovation, but 2025 seems to have outdone it. See my Top 10 highlights below. What did I miss?

Built By Berkeley Top 10 of 2025

Built By Berkeley tracked 609 VC-backed companies that collectively raised $65.9 billion in 2025. Wow!

Berkeley-founded Databricks raised $5B, reaching a $134B valuation. A monster Series L and possibly the most letters ever used for a private company’s funding rounds!?

Two Nobel Prize winners (Physics and Chemistry) with Berkeley connections

Waymo did 14 million autonomous trips in 2025. Fun fact, Tesla was also founded at Berkeley!

The largest seed rounds ever: $2B for Thinking Machines and $6.5B for Project Prometheus

Berkeley topped the PitchBook rankings with 1,650 VC-backed companies founded by undergrad alumni—270 more than second-place Stanford. Top of the Pops once again!

Some of the world’s biggest exits: The $900M Netskope IPO, $4.75B sale of Intersect Power to Google, and the $1–1.5B acquisition of Qualified by Salesforce, among many others.

OpenAI raised the largest VC funding round ever, $40B. It was co-founded by Berkeley alum John Schulman (who also co-founded Thinking Machines!).

6 Pulitzer Prize Winners and a fantastic new book about innovation on campus. ‘Startup Campus’ - congrats Mike Cohen, Darren Cooke, and Laura Hassner

Robotics looks set for a massive 2026 and beyond with Physical Inteligence raising $600M in 2025

Bonus achievement, the continued effort and success of new (ish) Chancellor Rich Lyons in promoting all things innovation and a shout out to the anonymous donor who gave $10M to support entrepreneurship at Haas.

Deal of the Week

2025 ended with a bang on the M&A front, with two massive deals from Google and Nvidia. Nvidia bought Groq for $20B in a funky licensing / acquihire-I-want-to-avoid-antitrust type deal. This will be a big win for early investors, including Chamath Palihapitiya, who I interviewed back when I was a student. The deal seems all about inference and fighting back against the Google TPU narrative. Groq’s chips are focused on delivering low-cost inference.

This deal had nothing to do with Berkeley, but on the other side of the AI stack—power—you saw Google buy Berkeley-founded Intersect Power for $4.75B. Congrats to its Haas MBA founder, Sheldon Kimber, on this monster win. While the Nvidia deal was all about inference, this deal was all about power. Throughout last year, big tech leaders were saying the bottleneck in AI development was power, not chips, and Intersect Power expands Google’s access to renewable energy projects to feed those hungry data centers.

Takeaways: Big tech is not slowing down and has the balance sheet to do massive deals. We spoke about the massive CAPEX party a few times last year. That party is now slowing down.

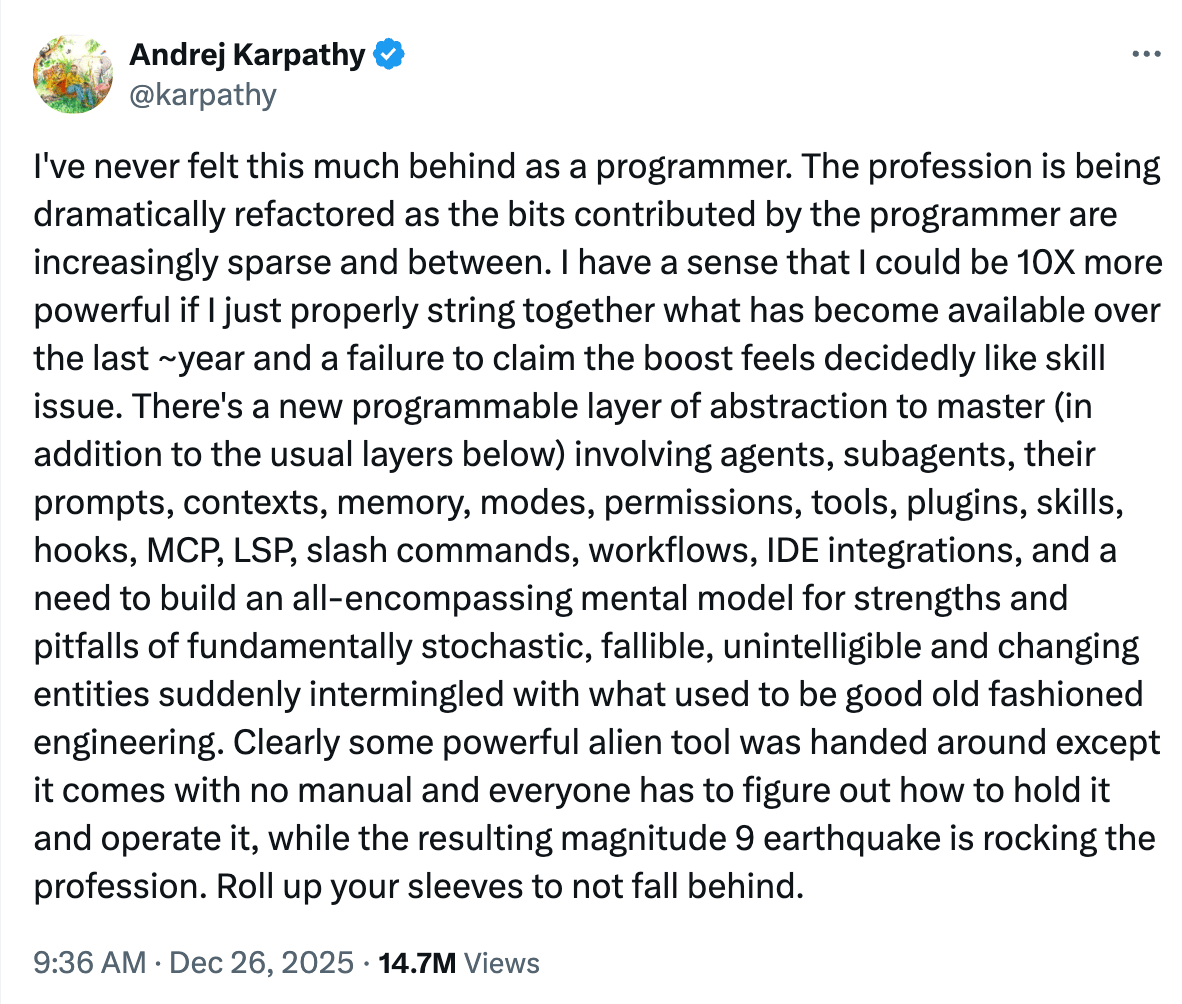

Falling Behind?

With everything that is happening in AI and the speed it is moving you can feel that you are constantly falling behind and that maybe you aren’t smart enough to follow everything. Well never fear this is not just you. Andrej Karpathy and original OpenAI co-founder (so I assume a pretty smart cookie) is also feeling a little lost out there. So 'Roll up your sleeves to not fall behind’

Quick Takes:

The FT got around to investigating the K-Shaped economy emerging that we discussed back in September

Interesting to see an Anthropic engineer decide to leave because he thinks Opus 4.5 is “as much AGI as I ever hoped for.” AGI (Artificial General Intelligence) is an interesting one as there isn’t really a clear definition, but one thing’s for sure: the new Anthropic model is very good. I remain convinced even with the level of AI we currently have a lot will change - the end of busy work. The future is here; it’s just not evenly distributed.

Summary by the #️⃣ & 💰:

3 Berkeley-founded companies funded

$59M of capital raised from the 22nd Dec to 28th Dec

💡 Got any ideas or feedback on how to improve this weekly digest? Just hit reply.

Acquisition / IPO

⚡️ Intersect Power. $4.75B Acquisition 🇺🇸 Utility-scale clean energy. 💰 Alphabet

🐻 Sheldon Kimber, CEO & Founder. Haas MBA Article

🚛 CiDi (Changsha). $182.7M IPO 🇨🇳 Autonomous driving systems. 💰 IPO

🐻 Zexiang Li, Founder & Chairman. MA Math & PhD EECS Article

Closed Rounds

🩺 BioIntelliSense. $58.1M Round 🇺🇸 Wearable patient monitoring. 💰 Dexcom Ventures, Philips Ventures, Chimera Capital

🐻 David Wang, CEO & Co-Founder. BS EECS Article

🌱 CarboVolt Labs. $1.0M Angel 🇺🇸 Electric carbon capture. 💰 Undisclosed

🐻 Danny Daniishev, CEO & Co-Founder. Haas MBA

🍓 Oishii. Undisclosed 🇺🇸 Vertical strawberry farming. 💰 Asahi Kogyosha Company

🐻 Hiroki Koga, Co-Founder & CEO. Haas MBA

Date Built By Berkeley Started | Companies Funded | Total Raised ($M) |

7/8/24 | 609 | 93,333 |

Our goal is to document the startup ecosystem of Berkeley-founded companies. Please share this newsletter with any Cal Bears in your network so we can crowdsource information about all investment rounds and job opportunities.

Did we miss a company or want to announce a round? Add it here, and we will post it next week.

Do you have a job you want to post from a Berkeley Company? Add here.

Is there someone in the Berkeley ecosystem that you would want us to do a profile on? A founder, funder, or general startup person? Add here.

Built By Berkeley is not affiliated with UC Berkeley, but maybe we will be one day if we get enough subscribers….

Built By Berkeley, where we announce all the funding rounds by Berkeley-founded companies. This is a community effort, so please let us know if we missed a company here. 🐻