- Built By Berkeley

- Posts

- Built By Berkeley

Built By Berkeley

SF Is Back. AI Is Surging. SaaS Is Getting Repriced - 7/52

Come and Hang at Cal Café w/ Canvas Prime & DTCP for some bagels and coffee on 19th Feb 2025 (This Thursday!). All Berkeley Founders, Funders & Friends invited.

Deal of the Week:

Congrats to Deep Fission on its $80M investment to advance the development of modular nuclear reactors underground. The U.S. is not adding the power it needs for the AI buildout, while China is. Nuclear is one potential area where additional capacity can be brought online. Hence the investor enthusiasm for companies like Deep Fission. Congrats to Berkeley grad Richard Muller on this massive milestone.

Shaazam a wild Berkeley journey

A few weeks ago, I was at a talk by one of the founders of Shaazam, Berkeley MBA grad Chris Barton. An amazing story — and one I didn’t realize had Berkeley origins.

You sort of take it for granted, but it’s a wickedly complex problem to solve: picking out the exact pitch of a song to identify it over background noise, remixes, and on phones that were mainly optimized for the human voice.

Eventually the company exited to Apple for $400M. It was around nearly eight years before the iPhone, and the initial way it worked was that you would text a number from your Nokia and it would automatically call you back. It was hard yards until the iPhone reduced the friction and created the right business model (iTunes referral). This then took off and eventually Apple gobbled it up.

Another amazing Berkeley story that does not get enough airtime!

SaaSpocalypse / SaaSacre is here

The markets are brutal and indiscriminately smashing SaaS companies against the perceived AI freight train. Anthropic released a legal plugin and large legal companies like Thomson Reuters sold off. Altruist released an AI tax tool and Charles Schwab and other wealth managers fell heavily. Insurance stocks dropped after OpenAI approved an insurance provider on ChatGPT.

The markets are febrile and frenetic, and the vigilantes are searching for the next AI victim. At the same time, the hyperscalers are getting hit for being too optimistic on AI. Can both be right?

Under the hood, most of the companies hit by these sharp sell-offs are actually beating numbers. What I believe is really happening is that the discount rate is increasing. For years, investors paid high revenue multiples for loss-making technology companies with heavy stock-based compensation under the belief that, eventually, these 90%+ gross margin businesses would compound into large free cash flow machines. That only works if revenues are durable and long-running.

AI has introduced uncertainty around margins, business models, and moats. And when uncertainty rises, a dollar today becomes more valuable than a dollar tomorrow. That is the increase in the discount rate. This is what the market is now pricing in — and it is doing so indiscriminately.

As I previously wrote:

Growth investors sitting in private SaaS companies may need to re-examine their valuations — see Rise of Zombicorns

Expect a volatile 2026 — see Narratives in the Age of AI.

Where will AI valuations end up? - see Brex Hit Gravity. AI Hasn’t.

Dislocation creates opportunity. I would argue many individual names have been oversold. Broadly, I remain bullish on hyperscalers, cyber, and select stocks.

In general, it will probably be hard to vibe-code serious SaaS applications, but maybe this sell-off is exactly the moment for these companies to get fit.

Should a company growing 20% a year be doing 20% stock-based comp? Probably not. So it’s either time to re-accelerate growth or start financialising the cash flows.

SF is back!

We called it early — SF is back (see company formation graph below).

At the start of last year, we predicted the narrative would shift, and it’s now playing out in spades. Return-to-office momentum, AI-driven company formation, and an energized mayor are all pushing in the right direction. Even the Financial Times, which used to run a hit piece on SF every few months, is now covering the city’s positive turn.

Quick Reads

For the record, I do not endorse commingling client capital with proprietary trading and it is rightly illegal. But purely from an investing lens, Sam Bankman-Fried appears to have had a good eye. He seems to be making the case for a pardon and recently highlighted his early investments in Anthropic, among other companies.

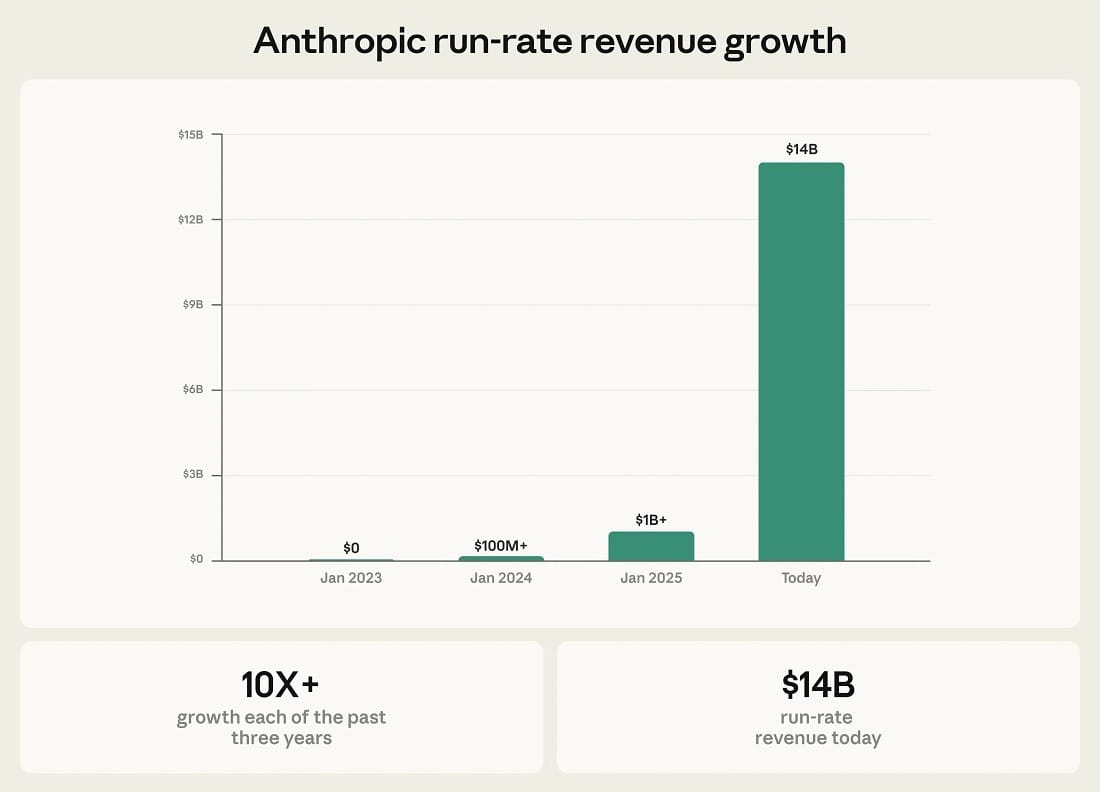

This revenue expansion in such a short period is truly unprecedented for Anthropic. This helps explain why it was able to raise an oversubscribed $30B round at a $380B valuation. I mentioned the “magic moment” I had with Claude in Excel last week, and it seems many others are having the same experience.

Summary by the #️⃣ & 💰:

5 Berkeley-founded companies funded

$94M of capital raised from the 9th Feb to 16th Feb

💡 Got any ideas or feedback on how to improve this weekly digest? Just hit reply.

Exits

🐻 Robert Wahbe, Co-Founder & CEO. BS. Article

Closed Rounds

⚛️ Deep Fission $80.0M PIPE 🇺🇸 Underground nuclear energy systems. 💰 Montrose Capital Partners

🐻 Richard A. Muller, Co-Founder & CTO. PhD Physics. Article

🏭 Archimetis $11.5M Series A 🇺🇸 AI for industrial operations. 💰 Borusan Ventures, Homebrew, Inspired Capital

🐻 Aaron Brown, CTO & Co-Founder. PhD & MS Computer Science. Article

🍦 Noah's Farm $2.7M Seed 🇸🇬 AI flavor discovery platform. 💰 Company K Partners, CRIT Ventures, Sazze Partners

🐻 Young-Jun Jang, Co-Founder & CEO. BS Business. Article

🤖 Shizuku AI Seed 🇯🇵 AI companion lab (stealth). 💰 Andreessen Horowitz

🐻 Akio Kodaira, CEO & Founder. PhD Meng Article

🩺 Skribe Medical Accelerator 🇺🇸 AI wearable cardiac diagnostics. 💰 Epsilon Ventures, GoAhead Ventures, Harvard Alumni Entrepreneurs Accelerator

🐻 Ryan Neely, CEO & Co-Founder. PhD Neuroscience. Article

Date Built By Berkeley Started | Companies Funded | Total Raised ($M) |

7/8/24 | 652 | 97,528 |

Our goal is to document the startup ecosystem of Berkeley-founded companies. Please share this newsletter with any Cal Bears in your network so we can crowdsource information about all investment rounds and job opportunities.

Did we miss a company or want to announce a round? Add it here, and we will post it next week.

Do you have a job you want to post from a Berkeley Company? Add here.

Is there someone in the Berkeley ecosystem that you would want us to do a profile on? A founder, funder, or general startup person? Add here.

Built By Berkeley is not affiliated with UC Berkeley, but maybe we will be one day if we get enough subscribers….

Built By Berkeley, where we announce all the funding rounds by Berkeley-founded companies. This is a community effort, so please let us know if we missed a company here. 🐻