- Built By Berkeley

- Posts

- Built By Berkeley

Built By Berkeley

The Berkeley Dream Factory

Deal of the Week

Adaptyx, founded by Vijit Sabnis , just announced an $18M round. The company is developing a wearable patch for continuous monitoring of multiple biomarkers such as hormones, electrolytes, drugs, and proteins. A lot of capital is headed to this space with two interconnected overarching themes: longevity and health span. Many companies have popped up doing more regular testing, such as Function Health, but for this, you need to go and get blood draws, which is both a pain and expensive. If Adaptyx can crack continuous monitoring, it could be a huge unlock, although likely a hard technical challenge. The future gorilla in the room here is Apple, which also seems to continually improve its health offering through Apple Watch announcements.

The Bull Case on AI by Coatue

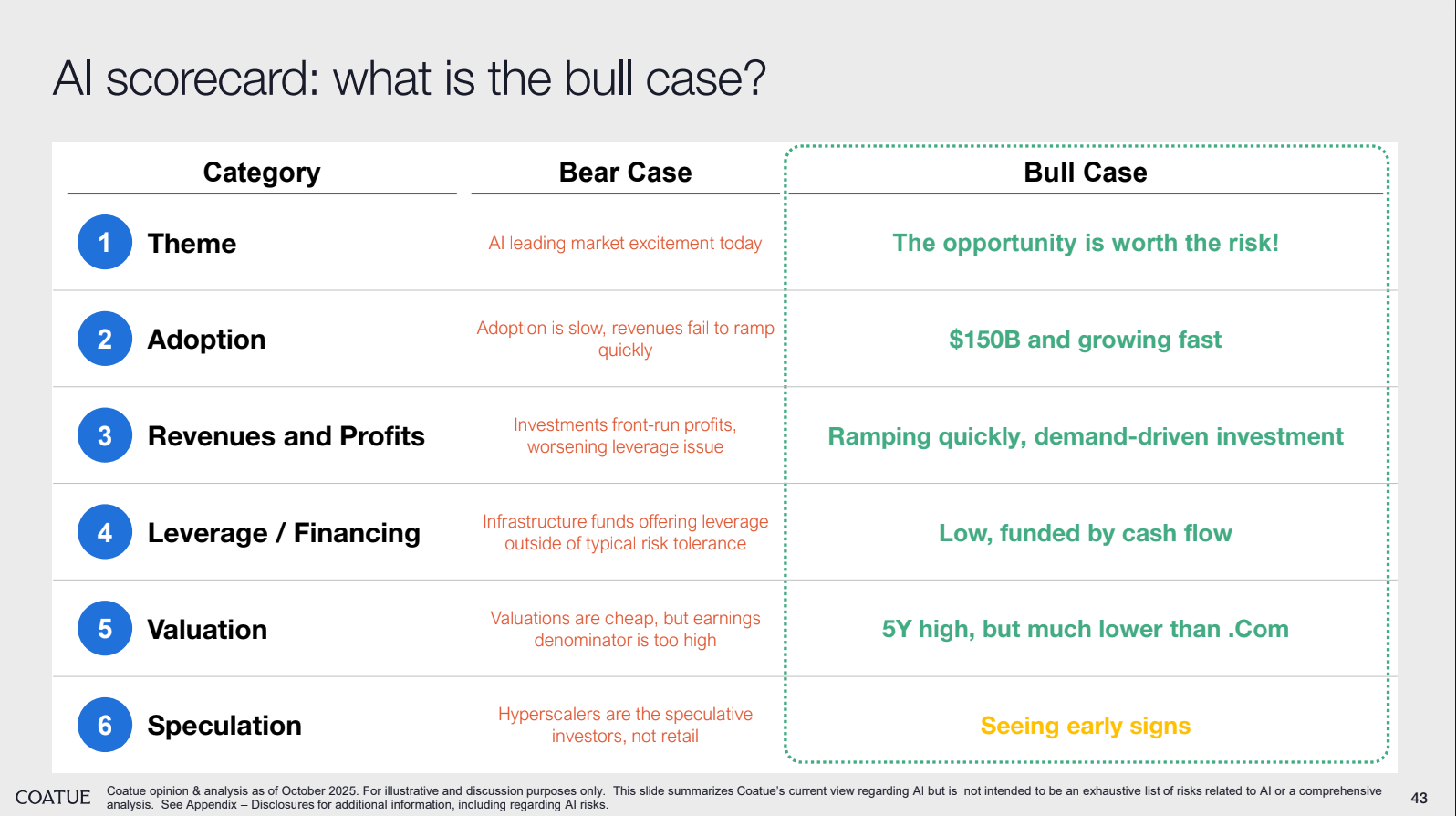

Always one for good charts Coatue (a $70B AUM cross over hedgefund) laid out their bull case for AI.

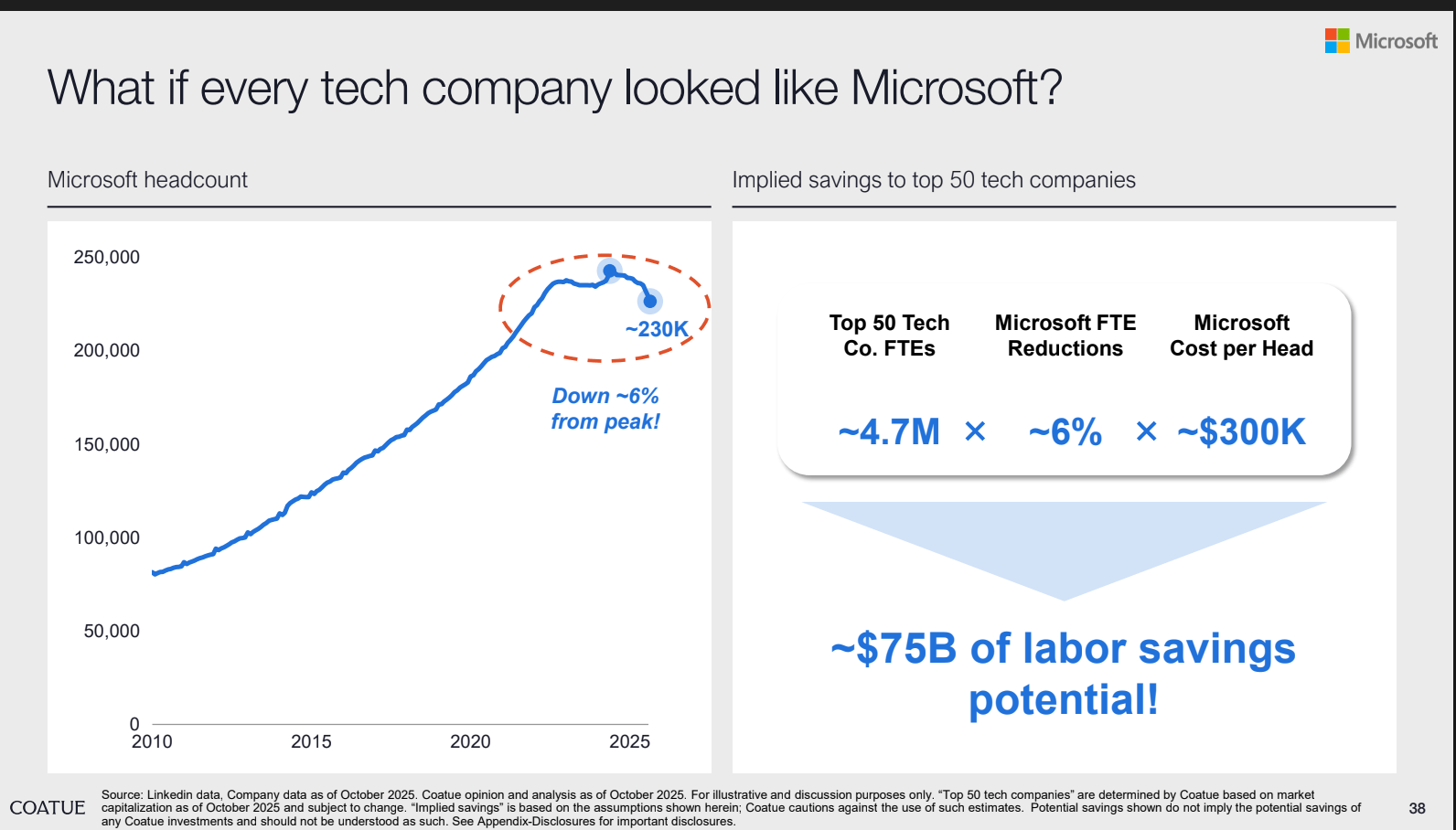

Part of the ROI case is the reduction or slowing in hiring at big tech companies such as Microsoft and others like Amazon, which have announced large layoffs while still growing revenues and profits rapidly. A lot of these firms overhired during COVID, but it does seem that, especially in big tech, companies are doing more with less. This is one of the bull cases for AI.

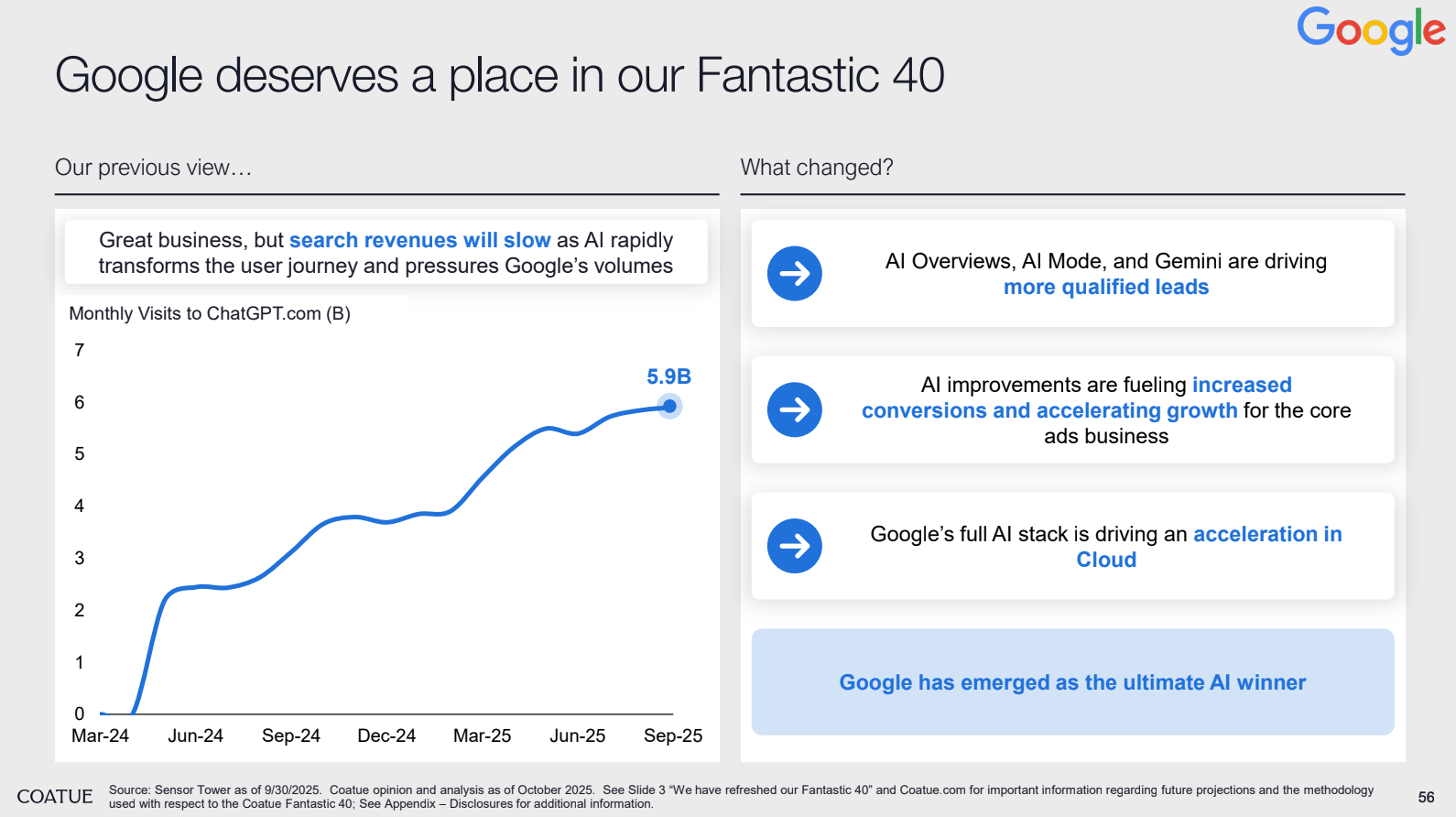

Looks like they also jumped on the Google wagon that I hit on a a while back (and up 40% since then)….that the ultimate AI winner is probably Google.

x

I also now believe Google is the ultimate AI hedge.

Why is Google an AI hedge?

The simplest bear case for AI is that adoption is slow and investments don’t translate into returns. In this scenario, Google has spent hundreds of billions of dollars on AI infrastructure, but:

It’s unlikely to remain idle — it would be used to improve Google’s core businesses in Search and YouTube through better-targeted ads. A lot of the infrastructure spending is also flowing into Google Cloud that is growing 30-40%+ a year driven this is likely to increase with the Amazon outage this week as people realize that multi cloud is a business necessity.

If AI adoption is slower than expected, Google’s Search business continues to throw off profits as one of the best business models capitalism has ever created.

None of Google’s infrastructure spending is debt-funded, and the company is so flush with cash that it’s conducting a $70B share buyback while spending around $100B a year on infrastructure. All while sitting on another $100B in cash. Bottom line: they’re not going anywhere.

Essentially, if AI is as big as expected, Google is likely to be a standout winner for all the reasons previously mentioned. But if AI fails to take off as quickly as expected, Google actually offers a long-term hedge. Provided you can withstand any short-term whiplash if markets move down.

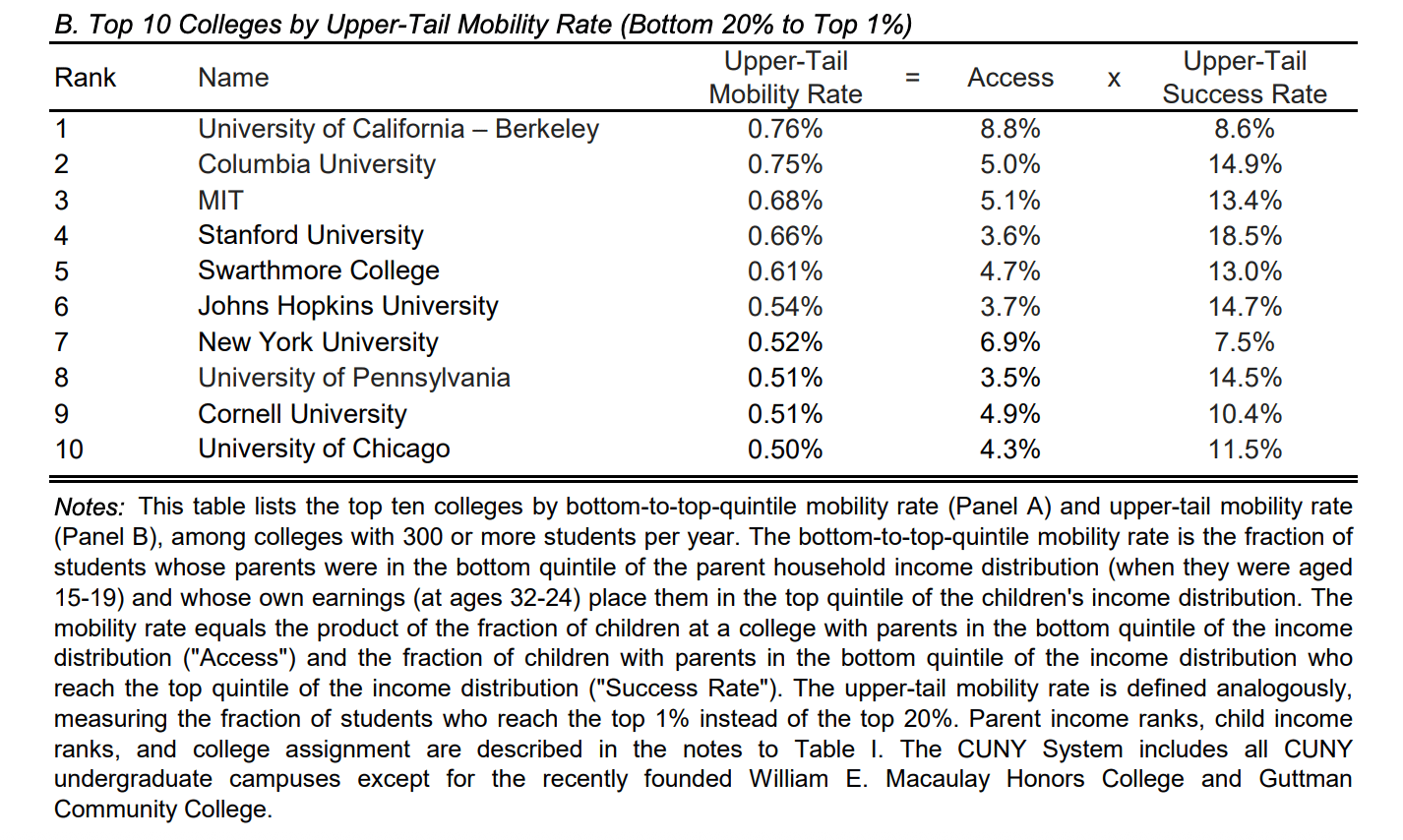

The Berkeley Dream Factory

Some recent research highlights the Berkeley dream factory. Showing that Berkeley ranks highest among colleges for upper-tail mobility, moving students from the bottom 20% to the top 1% of earners.

One thing I’ve noticed about Berkeley founders (though this does seem to be changing) is that Berkeley students typically skew less affluent than those from some other well-known startup institutions. This often means they start companies later, after working for a few years, likely due to student debt or family obligations. No real data for this, just a feeling.

The Atomisation of Data pipeline a big threat to the Foundational model providers?

My current top of mind thought is what is happening at the AI application layer or even in big AI users.

See below from Brian Chesky and Airbnb, about using Qwen (Alibaba’s frontier model) instead of ChatGPT due to cost and speed

This is the idea that you may not need a frontier model for every API call or use case. Do you always need a PhD when an intern might do? You’re starting to see companies like Cursor train their own models by leveraging their users’ data. This is existential for AI application companies as they look to improve margins and fend off the foundation models. However, if large enterprises start using a mix of models, it could be existential for the frontier model providers themselves.

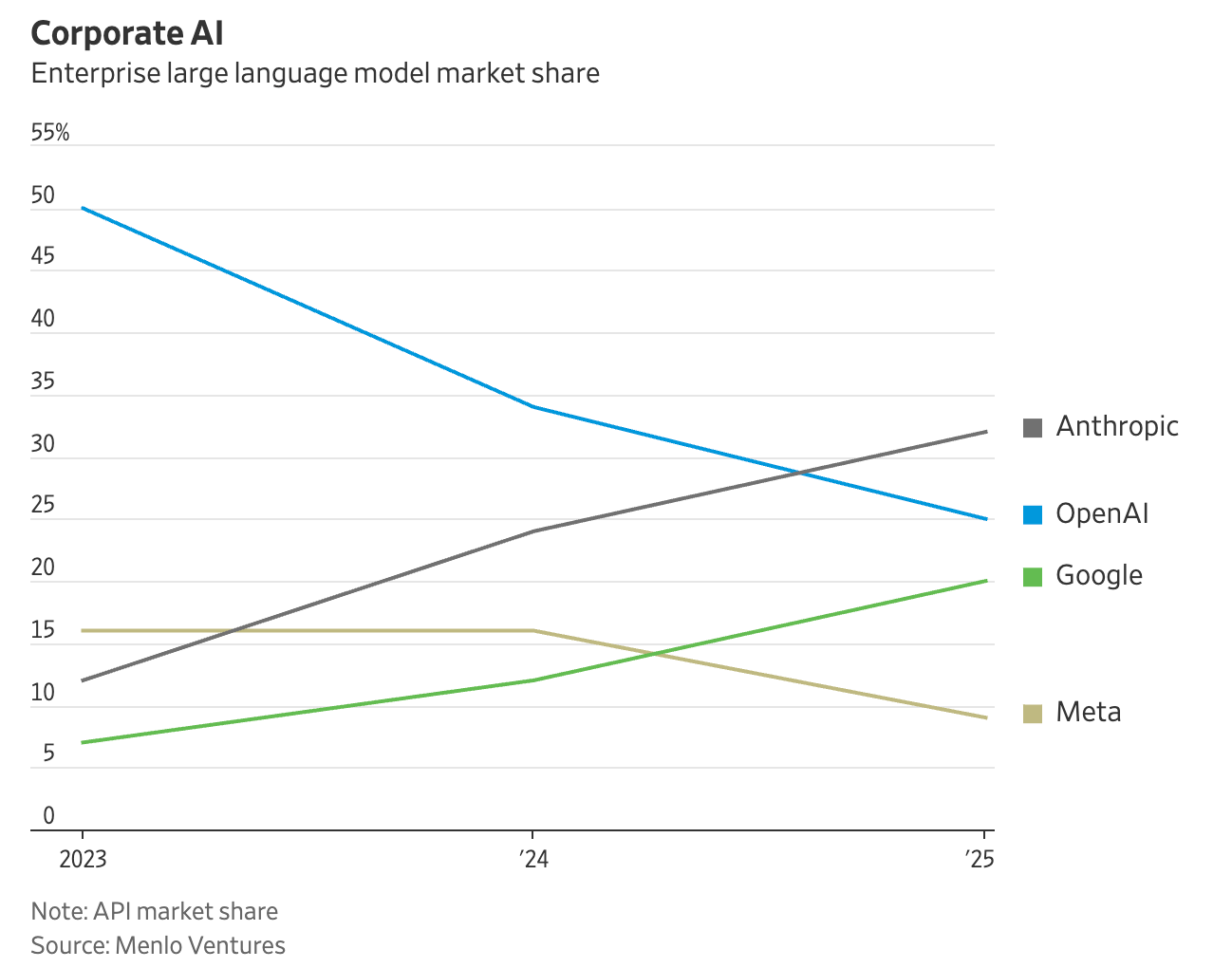

Semi-related but interesting: it seems Anthropic is now the leader in enterprise LLM share, though it would be fascinating to see how self-hosted open-source models fit into that picture.

Note: I am not sure how the data was complied and Menlo Ventures is a massive investor in Anthropic.

Summary by the #️⃣ & 💰:

5 Berkeley-founded companies funded

$56M of capital raised from the 20th Oct to 26th Oct

💡 Got any ideas or feedback on how to improve this weekly digest? Just hit reply.

Acquisitions

🎓 Pathrise Acquisition 🇺🇸 Career mentorship platform with income-sharing model. 💰 Springshare

Closed Rounds

🧠 Adaptyx $18M Seed 🇺🇸 Wearable sensor patch monitoring multiple metabolic health markers. 💰 Interlagos, Overwater Ventures, Starbloom Capital

🐻 Vijit Sabnis, Co‑Founder & CEO. BA EECS Article

🩺 Vitrivax $17.3M Series B 🇺🇸 Thermostable single‑shot vaccine formulation platform (ALTA®). 💰 Adjuvant Capital, RA Capital

🐻 Ted Randolph, Co‑Founder. PhD Chemical Eng Article

🧬 Generation Lab $11M Seed 🇺🇸 At‑home biological age test & longevity reports. 💰 Transpose Platform

🐻 Alina Rui Su, Founder & CEO. BS Bioengineering Article

💳 Bluwhale $10M Series A 🇺🇸 AI-powered financial health platform bridging traditional banking and blockchain. 💰 UOB Venture Management, SBI Holdings, PAID Network

🔍 Scopri.ai Angel 🇺🇸 R&D patent discovery engine for complex innovation. 💰 Undisclosed

🐻 Mateo Primorac, Co‑Founder & CEO. MS Materials Science

Date Built By Berkeley Started | Companies Funded | Total Raised ($M) |

7/8/24 | 526 | 79,989 |

Our goal is to document the startup ecosystem of Berkeley-founded companies. Please share this newsletter with any Cal Bears in your network so we can crowdsource information about all investment rounds and job opportunities.

Did we miss a company or want to announce a round? Add it here, and we will post it next week.

Do you have a job you want to post from a Berkeley Company? Add here.

Is there someone in the Berkeley ecosystem that you would want us to do a profile on? A founder, funder, or general startup person? Add here.

Built By Berkeley is not affiliated with UC Berkeley, but maybe we will be one day if we get enough subscribers….

Built By Berkeley, where we announce all the funding rounds by Berkeley-founded companies. This is a community effort, so please let us know if we missed a company here. 🐻