- Built By Berkeley

- Posts

- Built By Berkeley

Built By Berkeley

💾 DreamBig sells big, ☁️, Meta spends big, and 🌲 Sequoia makes big changes

Deal of the Week

DreamBig Semiconductor announced the $265M acquisition by ARM. DreamBig is effectively a chip design business focused on accelerating AI compute performance through better GPU-to-GPU connection, and ARM wants to expand its data center offering—hence the acquisition.

DreamBig was co-founded by alum Weili Dai—she must be one of the best Berkeley founders out there, especially in semiconductors. Along with DreamBig, she co-founded Marvell (NASDAQ: MRVL), an $80B listed semis business, and a couple of others. Even in companies she didn’t found, she seems to have big wins. How does she do it?! If only we knew…

Also, definitely an honorable mention in Deal of the Week for Azumi Restaurants. Did you know the founder of Zuma (famous for bottomless brunches 😜) and ROKA, Arjun Waney, went to Berkeley!? This is unverified, but pretty cool. Keep finding cool founders who went to Cal.

Mark in the Dog House

Amazon, Google, and Microsoft all had strong earnings last week, underlined by accelerating growth in the cloud. The stock market punished Meta, which had strong revenue growth of 26% at scale, but signaled that CAPEX growth was not going to slow down. The main problem people have with Meta is that, unlike the other companies, Meta does not directly make money from its CAPEX, unlike Alphabet, Amazon, and Microsoft, which have massive cloud businesses.

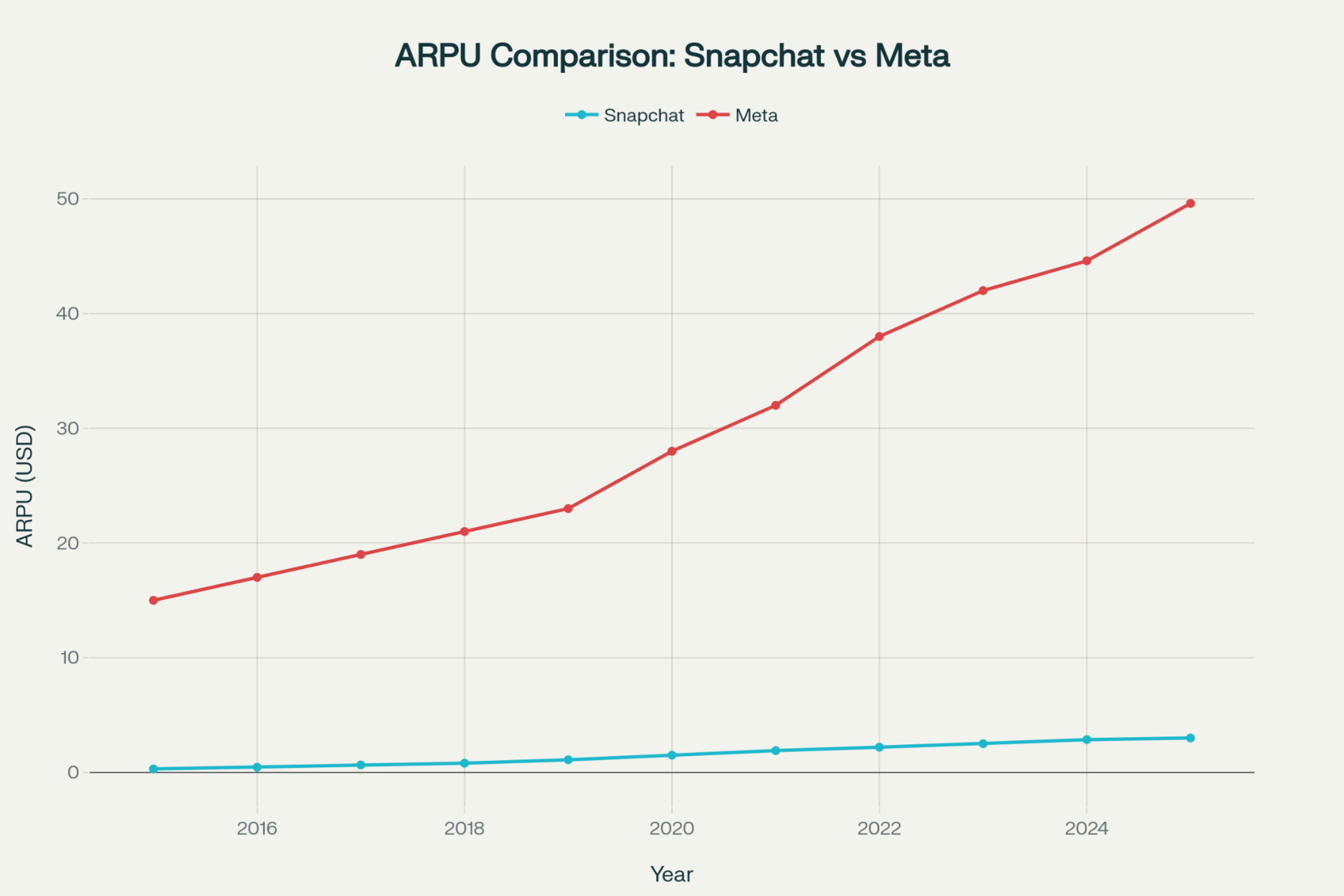

One chart to think of here is the sustained ability of Meta to generate more revenue from its users (ARPU = Average Revenue Per User). So, if they think all of these GPUs they're buying will drive more revenue, there’s probably some truth to it.

Xan in Perplexity

Bottom Line: Mark likes to take big swings, and he’s had some big wins with WhatsApp and Instagram. So don’t bet against him…although the metaverse looks like it was a money pit. I’m a Meta buyer at these prices, as have a feeling Mark has a crafty grand plan.

Trouble at Sequoia?

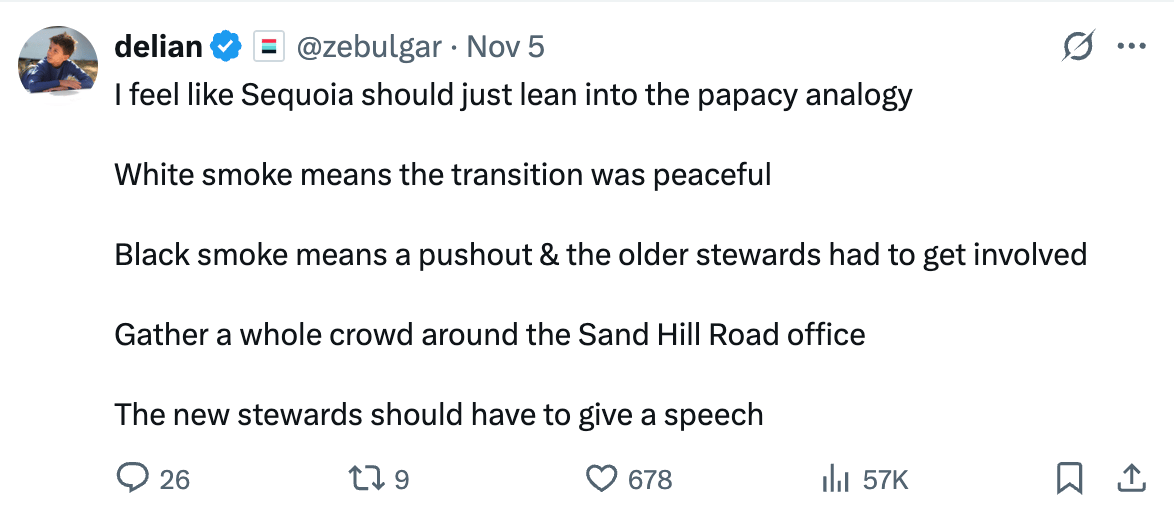

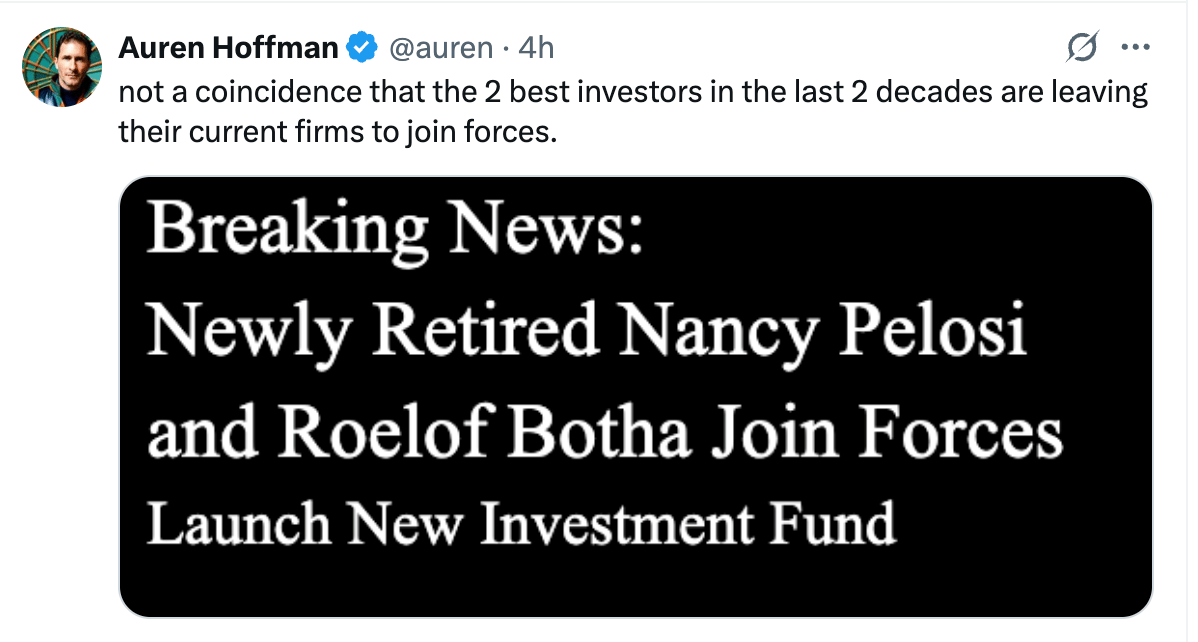

Sequoia is one of the most storied firms in Silicon Valley, so when there’s some scuttlebutt, it tends to go viral quickly. Roelof Botha, the lead partner, stepped down this week after just a couple of years in the role, and he’s only just over 50. Some reports suggest that a few other partners disagreed with the direction of the firm. The result is that Pat Grady and Alfred Lin are now in charge. All three are excellent investors. My only comment is about timing — Roelof was on two great podcasts recently (1, 2), and he didn’t sound like someone reminiscing on his career.

Who knows the real story, but you got to love the memes:

If you want to understand the Nancy Pelosi context read here.

Bottom Line: Sequoia remains the go-to firm for founders raising capital. I attended a talk a few years ago by Doug Leone, one of Sequoia’s long-time senior GPs, and their track record is incredible — 30% of the Nasdaq was funded by Sequoia.

At the time, they had backed over 400 IPOs with a combined market value of $7 trillion. That talk was three years ago. Now, just three Sequoia-backed companies alone (Apple, Google, and Nvidia) represent over $12.3 trillion in market cap. They were also behind many of this year’s biggest IPOs, including Klarna and Figma.

Short Takes

Stripe released a chart showing the speed of revenue growth of US AI startups vs. the UK and EU. If you believe this it would show that the US is once again accelerating vs. the EU and UK.

This is a man who is feeling on top of the world - Jensen Huang eating Pocky sticks while chatting to investors.

Warren Buffett’s final Berkshire Annual Letter. End of an Era. As the British would say, I’m “going quiet.’’

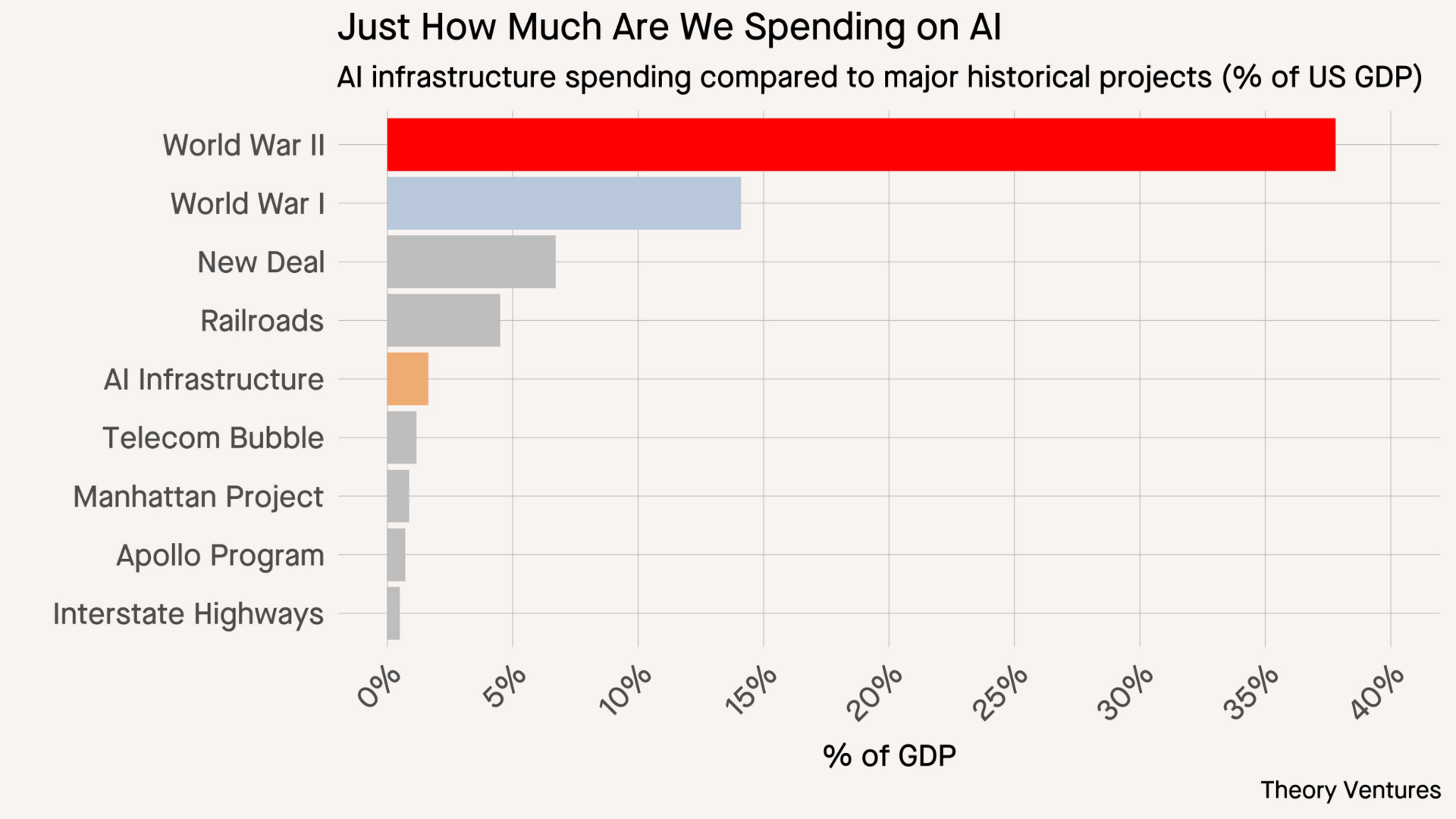

Keep seeing cool charts on where the AI infrastructure buildout compares to other buildouts in the US. The best comparison is probably the railroads as the new deal and the wars were more government than private funded.

Summary by the #️⃣ & 💰:

7 Berkeley-founded companies funded

$298M of capital raised from the 3 Nov to 9th Nov

💡 Got any ideas or feedback on how to improve this weekly digest? Just hit reply.

Acquisitions / IPOs

🍣 Azumi Ltd. Secondary 🇬🇧 Japanese izakaya-style hospitality group. 💰 Undisclosed

🐻 Arjun Waney, Co‑Founder. Attended UC Berkeley (1957). Article

🖥️ DreamBig Semiconductor $265M Acquisition 🇺🇸 High-performance data center chipmaker. 💰Arm

🧠 EyePACS Acquisition 🇺🇸 Telemedicine platform for eye care. 💰 Optain Health

🐻 Jorge Cuadros, Founder & CEO. Director of Informatics Research, UC Berkeley School of Optometry. Article

⚙️ Mantle Acquisition 🇺🇸 Metal 3D printing for tooling. 💰 Angstrom Group

🧬 Arcus Biosciences $287.5M Public Offering 🇺🇸 Immunotherapies for cancer. 💰 Public Investors

🐻 Terry Rosen, Co‑Founder & CEO. BA, Chemistry. Article

🧪 4D Molecular Therapeutics $88.1M Public Offering 🇺🇸 Targeted gene therapy. 💰 Public Investors

🐻 David Kirn, Co‑Founder & CEO. BA, Physiology. Article

🧠 VERSES AI Inc. $7M Public Offering 🇺🇸 Cognitive computing systems. 💰 Undisclosed investors

Closed Rounds

🩺 Hippocratic AI $141M Series B 🇺🇸 Healthcare general intelligence. 💰 Andreessen Horowitz, General Catalyst, Kleiner Perkins

🐻 Meenesh Bhimani, Co‑Founder & CMO. BS Molecular & Cell Biology. Article

🧬 Tempero Bio $70M Series B 🇺🇸 Substance use disorder therapies. 💰 Aditum Bio, Khosla Ventures, 8VC

🐻 Joe Jimenez, Co‑Founder. Haas MBA

🏗️ Synonym Bio $18.4M Series A 🇺🇸 Biomanufacturing infrastructure platform. 💰 Andreessen Horowitz, Global Founders Capital, In‑Q‑Tel

🐻 Edward Shenderovich, Co‑Founder & CEO. BA. Article

🐻 Prashan Dharmasena, Co‑Founder. BS EECS. Article

♻️ Flow Environmental Systems $3.1M Series A 🇺🇸 HVAC decarbonization tech. 💰 Undisclosed

🐻 Navaid Burney, Co‑Founder & CFO. BS Mechanical Engineering. Article

🧮 Wolley $3M 🇺🇸 Memory controllers for SSD. 💰 Undisclosed

🐻 Bernard Shung, Founder & President. PhD EECS. Article

🌍 Antara Health Undisclosed 🇰🇪 Virtual-first primary care. 💰 MaC Venture Capital, Zephyr Management, Anorak Ventures

🐻 Kuang Chen, Co‑Founder & CTO. PhD, Computer Science. Article

Date Built By Berkeley Started | Companies Funded | Total Raised ($M) |

7/8/24 | 548 | 80,459 |

Our goal is to document the startup ecosystem of Berkeley-founded companies. Please share this newsletter with any Cal Bears in your network so we can crowdsource information about all investment rounds and job opportunities.

Did we miss a company or want to announce a round? Add it here, and we will post it next week.

Do you have a job you want to post from a Berkeley Company? Add here.

Is there someone in the Berkeley ecosystem that you would want us to do a profile on? A founder, funder, or general startup person? Add here.

Built By Berkeley is not affiliated with UC Berkeley, but maybe we will be one day if we get enough subscribers….

Built By Berkeley, where we announce all the funding rounds by Berkeley-founded companies. This is a community effort, so please let us know if we missed a company here. 🐻