- Built By Berkeley

- Posts

- Built By Berkeley

Built By Berkeley

From Eldercare to Autonomous Driving — Cal Founders Pulled in $334M

Deal of the Week

SirenOpt. This one is a fun one for me. I invested in Jared and the team a few years ago via Courtyard Ventures (portfolio here!) — check out Why We Invested here. They just announced $9M of funding: a $2.5M non-dilutive grant and a $6.5M round led by Hitachi and InMotion Ventures, the VC arm of Jaguar.

SirenOpt is reinventing the manufacturing process. Using AI and low-temperature plasma lasers, they can analyze material properties in real time. Previously this was a task that required removing samples from the production line and testing them destructively. For example, in solar panel production, the thin film layer is inherently probabilistic, meaning some percentage is always failing so requires a lot of testing and when the only way to test it was to destroy small pieces and extrapolate the test to the broader sample you have a suboptimal solution. SirenOpt’s non-invasive technique changes that, allowing continuous, real-time inspection.

Jared developed the technology during his Berkeley PhD and even convinced his professor to join him. Always a good sign!

Why is this exciting? It’s all about yield, which is the percent of product you can keep. The higher the yield, the better the cost structure. SirenOpt plans to scale across major production lines globally, so it’s no surprise Hitachi and Jaguar are excited.

Note for founders: Grants are underrated. They’re non-dilutive and, with AI, increasingly accessible. No excuses not to try.

Zombiecorns?

A later-stage fund recently mentioned they have a number of $100M+ ARR SaaS companies that no one wants to buy. I touched on this in more detail previously. It’s a fascinating phenomenon — on the surface, these are successful businesses, but because they are often i) unprofitable, ii) exposed to potential AI disruption, or iii) not in a strong market position, therefore there are few buyers. I was reminded of this again this week by a tweet. Usually, when sentiment is this negative, it sets the stage for some really interesting deals and strong returns as people take advantage of dislocations.

Bubble?

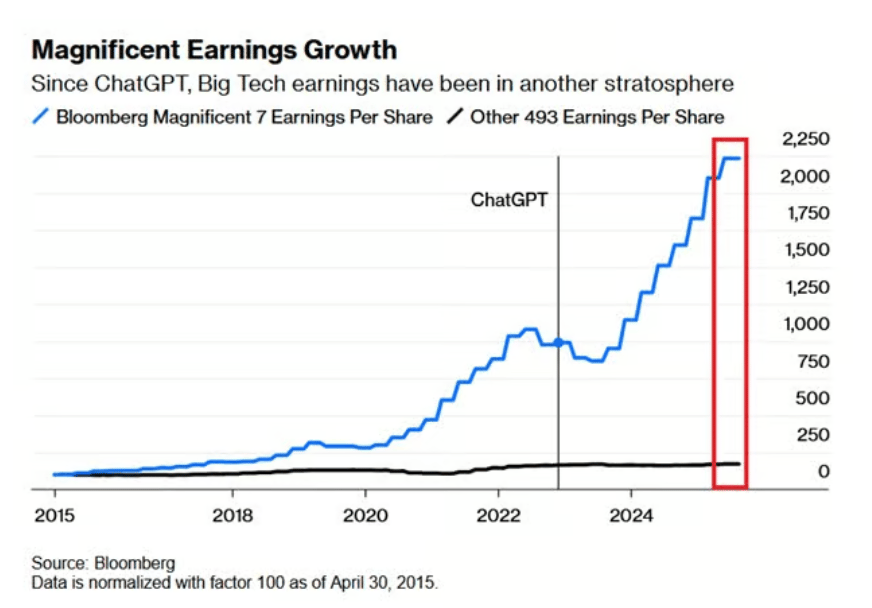

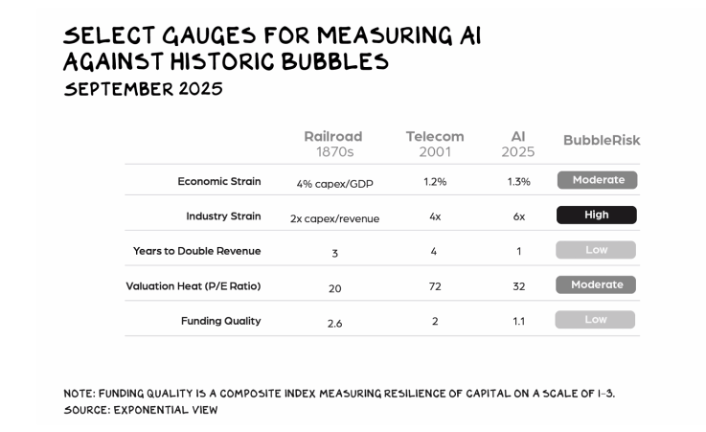

I remain convinced that even when the “bubble” bursts, we’re building the railroad tracks for the next evolution of the economy and even if AI progress stops so much can be done. Massive amounts of capital is flowing into infrastructure, but most of it is being laid down by hyperscalers with cash-gushing businesses (over 50% of Nvidia’s customers are just three hyperscalers!). So if people lose faith in AI’s progress or usage is less than they expect, these companies aren’t going anywhere. They will have just made some poor investments with their free cash flow. For now, though, AI seems to be massively benefiting the big players.

Scott Galloway (Haas MBA) does a good post with his view on where we are in the AI/economic cycle.

If I were a betting man (which I am!), I would say the pull back comes from left field and not because of AI. My hunch is it comes from somewhere else entirely, maybe government debt or another area where we’re already starting to see some dislocations in areas like Silver and Gold.

Hot Takes

Last week my prediction was that Anthropic would buy Lovable or another vibe-coding startup — and it looks like The Information just broke a piece on exactly that. They’re reportedly beefing up the corp dev team and plan to go company shopping.

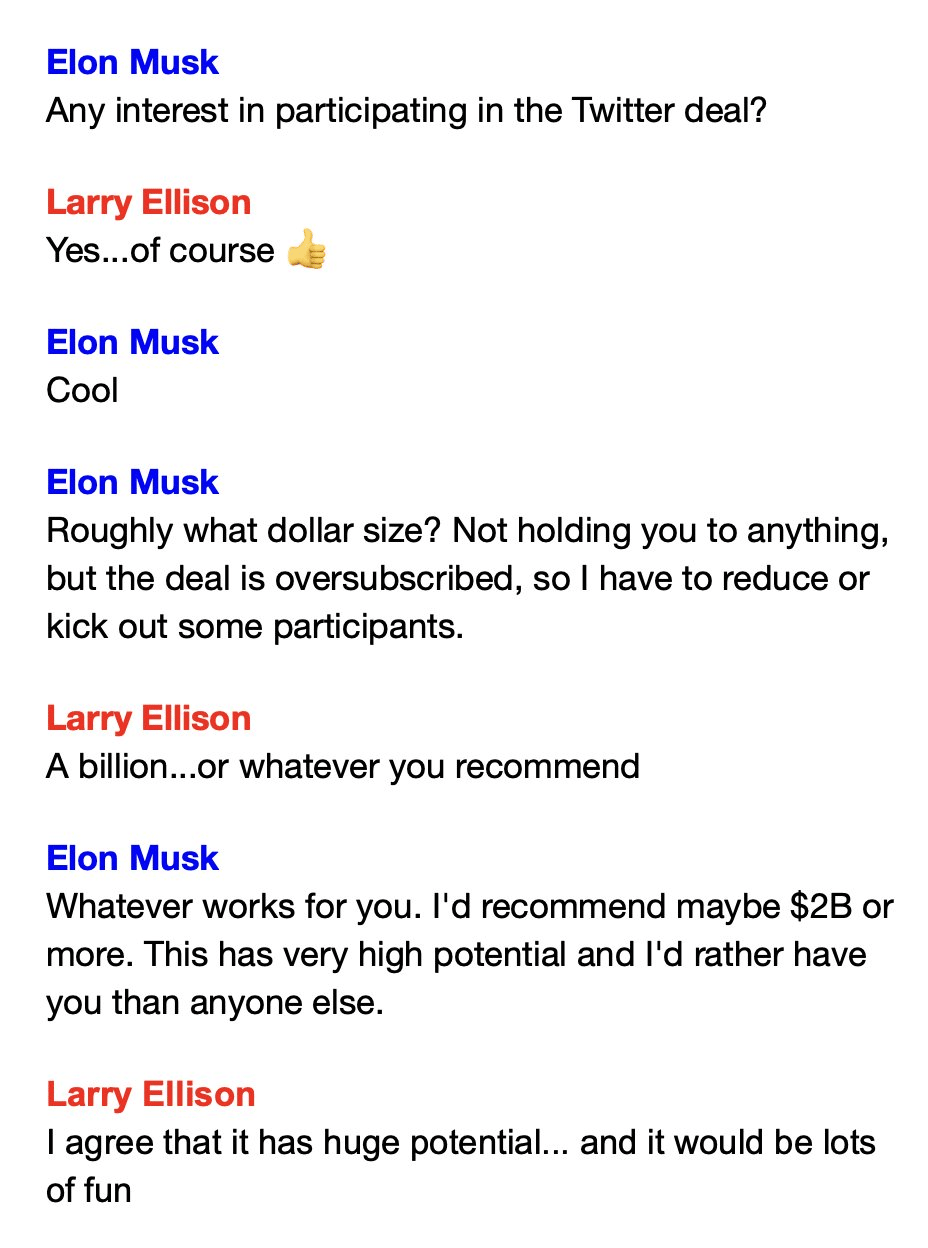

What’s your number? It seems Andrew Tulloch — who famously turned down a $1B offer to return to Meta — has now rejoined for $1.5B. He was a co-founder of Thinking Machines, which recently raised $2B at a $12B valuation (and yes, Berkeley-founded!). Would love to see the whatsapp conversation between Mark Zuckerberg and Andrew for this one, maybe we will get in the next anti trust case…feels it might be as good as the one between Larry Ellison and Musk to invest $2B into twitter.

On the reading list is the profile of Josh Kushner and Thrive Capital. An impressive platform is being built there.

Summary by the #️⃣ & 💰:

10 Berkeley-founded companies funded

$334M of capital raised from the 13th Oct to 19th Oct

💡 Got any ideas or feedback on how to improve this weekly digest? Just hit reply.

Acquisitions

🐻 Arthur Bretschneider, Co‑Founder & CEO. Haas MBA Article

📚🛠️ WorkRamp. Acquisition 🇺🇸 Learning platform for employee training. 💰 Learning Pool

Closed Rounds

🚀🧬 Kardigan. $254M Series B 🇺🇸 Heart‑health biotech revolutionizing cardiovascular treatment. 💰 ARCH Venture Partners, Fidelity Management & Research Company, Sequoia Heritage

🐻 Bob McDowell, Co‑Founder & Chief Scientific Officer. BA Cell Biology Article

🧠🤖 Viven. $35M Seed 🇺🇸 AI‑driven “digital twin” for employees to preserve knowledge and automate workflows. 💰 Foundation Capital, FPV Ventures, Khosla Ventures

🐻 Varun Kacholia, Co‑Founder & CTO. MS EECS Article

🧪🦠 Pheast Therapeutics. $24.6M Seed 🇺🇸 Macrophage-targeted cancer immunotherapy. 💰 ARCH Venture Partners, Catalio Capital Management

🍐📊 Pear Suite. $7.6M Series A 🇺🇸 SDOH care navigation platform. 💰 Flare Capital Partners, Mucker Capital, Third Act Ventures

🐻 Colby Takeda, Founder & CEO. MPH Article

🔬📉 SirenOpt. $6.5M Undisclosed 🇺🇸 Low energy plaza and AI for thin film manufacturing software. 💰 Courtyard Ventures, Hitachi Ventures, InMotion Ventures

🐻 Jared O'Leary, Co‑Founder & CEO. PhD Chemical Engineering Article

🌪️🏢 Class 3 Technologies. $3.5M Seed 🇺🇸 Climate risk simulation platform. 💰 Powerhouse Ventures, Sustainable Future Ventures, Tailwind Futures

🐻 Ibbi Almufti, Founder & CEO. MS Seismic Eng Article

🏃♂️🦾 ATDev. $3M Seed 🇺🇸 Robotic rehab for physical therapy. 💰 Berkeley SkyDeck Fund, BR Venture Fund, UpHonest Capital

🐻 Todd Roberts, CEO & Founder. MEng Mechanical Eng Article

🤖🏥 Diligent Robotics. Accelerator 🇺🇸 AI-powered hospital robots. 💰 True Ventures, Tiger Global Management

🐻 Vivian Chu, Co‑Founder & Chief Innovation Officer. EECS Embedded Software Article

🚗🧠 Helm.ai. Undisclosed 🇺🇸 Autonomous driving AI stack. 💰 Fontinalis Partners, Goodyear Ventures, Sound Ventures

🐻 Vladislav Voroninski, CEO & Founder. PhD Maths Article

🧠💬 MedLink Global. Accelerator 🇺🇸 AI-powered psychiatric evaluation platform. 💰 Mayo Clinic Platform

🐻 Ran Yang, Founder & CEO. Haas MBA Article

Date Built By Berkeley Started | Companies Funded | Total Raised ($M) |

7/8/24 | 521 | 79,933 |

Our goal is to document the startup ecosystem of Berkeley-founded companies. Please share this newsletter with any Cal Bears in your network so we can crowdsource information about all investment rounds and job opportunities.

Did we miss a company or want to announce a round? Add it here, and we will post it next week.

Do you have a job you want to post from a Berkeley Company? Add here.

Is there someone in the Berkeley ecosystem that you would want us to do a profile on? A founder, funder, or general startup person? Add here.

Built By Berkeley is not affiliated with UC Berkeley, but maybe we will be one day if we get enough subscribers….

Built By Berkeley, where we announce all the funding rounds by Berkeley-founded companies. This is a community effort, so please let us know if we missed a company here. 🐻