- Built By Berkeley

- Posts

- Built By Berkeley

Built By Berkeley

High-end berries and high-stakes power: Inside the week’s $463M Berkeley-founded rounds

Deal of the Week:

We reported on Oishii last week (and if you missed it, check out our 2025 roundup!). What I didn’t have at the time was the size of the round, which now appears to be $450M at a $1.2B post-money valuation. That is a lot of strawberries or a berry big fundraise 😉.

Oishii is a vertical farming company founded by Haas MBA Hiroki Koga, who originally took the idea through UC Launch (and won!). This one is fascinating to me. I spent some time looking at vertical farming in the past, and it always struck me as massively challenging from a unit economics perspective:

expensive urban real estate,

limited pricing power for the product, and

high input costs vs. traditional agriculture (energy, etc.).

Many startups have tried and failed here (AeroFarmsm Appharvest, Fifth Season etc). but Oishii looks like it might be one that breaks out. Why? From my limited vantage point, they seem to have succeeded where others haven’t for a few key reasons. They went premium from day one with strawberries, and not just any strawberries, but fancy premium Japanese varieties. These reportedly retail for around $2–6 per berry versus around $0.20–0.50 for typical supermarket strawberries, which makes a huge difference to the unit economics!

They’ve also been smart and thoughtful about building a brand centered on premium Japanese quality, which has given them real pricing power. If you can combine strong branding with pricing power, you can offset expensive real estate and input costs and eventually reach scale to push production costs down further.

Congrats to the team and also a reminder just because many have failed before does not mean a slight tweak, why now or just force of a nature founder can will a business into existence.

China & the US

Highly recommend reading Dan Wang’s annual letter. Dan is an author of a well reviewed book on China, and he writes eloquently on San Francisco tech and China’s industrial policy. Having spent nearly 8 years living in Asia (with investments in China), I found it a fascinating read.

My only addition to this discourse is that since COVID, I have seen far fewer Chinese tourists outside of China (more anecdotal than data supported if anyone has the data great!), and I believe there are also fewer expats living there. Dan touches on this idea, but it does seem that as the world becomes more polarised, part of the issue is that both sides are less willing to fully understand the other. Not the most positive development.

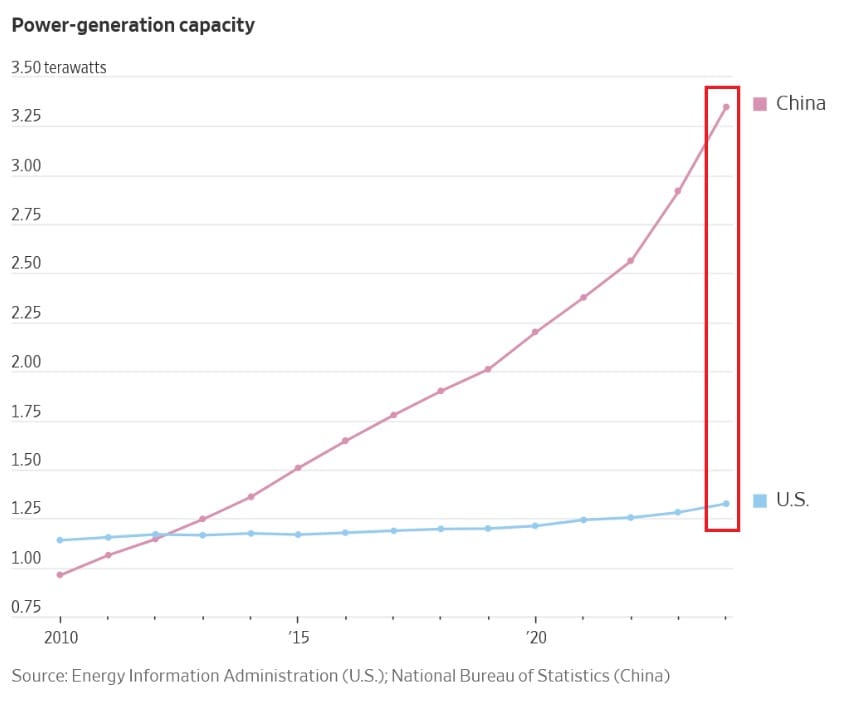

Lastly I think everyone needs to internalise this graph - China is winning in the power race. If you read everything the big tech CEO’s are saying there are massive bottle necks in power, hence why Google bought Berkeley founded Intersect Power last week. The US is making strides here to catch up, but much more can and should be done. It used to be said that data was the new oil, but maybe it should be power is the new oil.

Quick Takes:

Great 2026 predictions article by Scott Belsky

Warren Buffet has officially stepped down from Berkshire Hathaway. He leaves behind a business with a $1.1T market cap and over $380B in cash. Most impressively, he is 95. Amazing to be working that long, and a true testament to his love of the game

Summary by the #️⃣ & 💰:

3 Berkeley-founded companies funded

$463M of capital raised from the 29th Dec to 4th Jan

💡 Got any ideas or feedback on how to improve this weekly digest? Just hit reply.

Acquisition / IPO

📹 Eagle Eye Networks Merger 🇺🇸 Cloud video surveillance. 💰Brivo

🐻 Dean Drako, Founder & CEO. MS EECS Article

Closed Rounds

🍓 Oishii. $450M 🇺🇸 Vertical strawberry farming. 💰 Asahi Kogyosha Company

🐻 Hiroki Koga, Co-Founder & CEO. Haas MBA

🧥 Argent $8.5M Series B 🇺🇸 Women’s professional workwear. 💰 Founders Fund, Fuel Capital, Sugar Capital

🐻 Sali Christeson, Founder & CEO. Haas Article

🔗 Pontoro $4.1M Series A 🇺🇸 Digital asset securitization. 💰 Alumni Ventures, Fin Capital, Quest Venture Partners

🐻 Antonio Vitti, CEO & Founder. Haas MBA Article

Date Built By Berkeley Started | Companies Funded | Total Raised ($M) |

7/8/24 | 611 | 93,796 |

Our goal is to document the startup ecosystem of Berkeley-founded companies. Please share this newsletter with any Cal Bears in your network so we can crowdsource information about all investment rounds and job opportunities.

Did we miss a company or want to announce a round? Add it here, and we will post it next week.

Do you have a job you want to post from a Berkeley Company? Add here.

Is there someone in the Berkeley ecosystem that you would want us to do a profile on? A founder, funder, or general startup person? Add here.

Built By Berkeley is not affiliated with UC Berkeley, but maybe we will be one day if we get enough subscribers….

Built By Berkeley, where we announce all the funding rounds by Berkeley-founded companies. This is a community effort, so please let us know if we missed a company here. 🐻